How Much Money Do You Need to Retire?

Planning for retirement is an important financial step for the development of one’s welfare at old age. Choosing the correct amount mainly depends on the lifestyle, expected costs, and the age that the person wants to retire at. Specialists recommend the replacement of 80% to 90% of the retirement income, but the needs of each individual are different.

Understanding Income Replacement Ratios

Income replacement takes as its base the percentage of annual pre-retirement earnings, which is essential to still maintain a comfortable lifestyle. From a lot of financial advisors, they say that the income replacement rate is 80% to 90%. If the person attains an income of $100,000 per year before retirement, he/she might need $80,000 to $90,000 yearly after retirement. This calculation gives special attention to the reduction of expenses.

Age-Based Savings Milestones

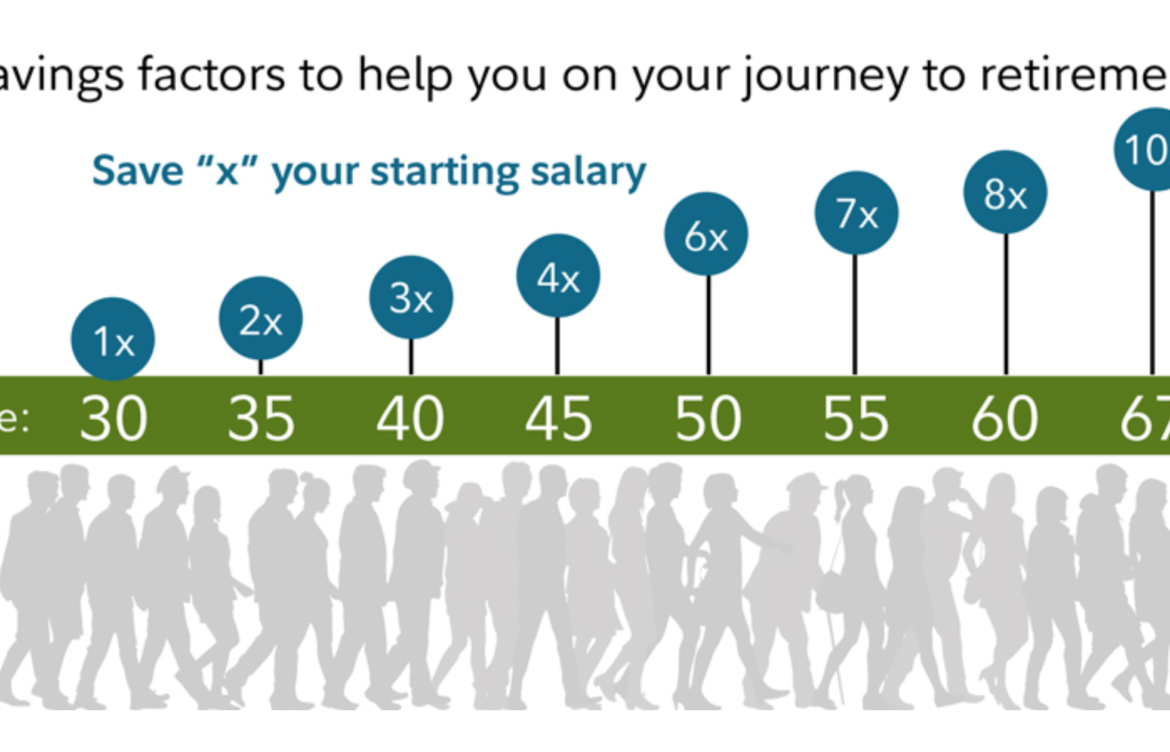

Setting savings objectives at various stages in your life would make you execute your goals in a disciplined manner. Fidelity Investments assumes that you will save an amount that equals your salary by age 30, three times it by age 40, six times it by age 50, eight times it by age 60, ten times it by age 64, and ten times it by age 67. These steps help you gather enough money to maintain your retirement dreams.

The Importance of Retirement Savings

The older you get, the higher medical expenses are, hence, healthcare costs are the most crucial consideration. Inflation is a growing puzzle that decreases the amount of purchasing power hence you should save money to keep up with increasing expenses. The lifestyle you long for, which involves travel or other leisure activities, is also having a say in matters of personal finance.

Calculating Your Retirement Savings Goal

First and foremost, I begin with calculating the cost of daily expenses paying for housing, food, and healthcare. The resulting figure is the total amount of money that you will save in a retirement period. Assume that the changes in investments and the shrinking buying power of a dollar are influenced by inflation.

The significance of retirement calculators

Retirement devices offer personalized projections of savings, wages, and anticipated costs. The NerdWallet Retirement Calculator can help individuals make informed decisions by comparing their financial positions with projections. Other tools consider the person’s current savings, the expected retirement age, and the choices they’ll make during retirement for calculating the amount.

Strategies to Achieve Retirement Goals

There are many ways a person can reach their retirement savings goals, and a few of these ways are discussed in this article. Increasing contributions to retirement accounts, such as 401(k)s and IRAs, skyrockets the rate of saving. Acting the waiting time for retirement things also allows for more time in the investment exposition and also for the fewer years remaining for the funds.

The Part of Social Security in Retirement Planning

It is true that social security constitutes a part of the retirement income, but it is quite insufficient to cover every need. The social security benefits are totally dependent on the life earnings as well as the retiring age of the beneficiary. When you delay the full retirement age and wait longer to receive benefits, the amount of money you will get each month will be higher.

The Effect of Inflation on Retirement Savings

Inflation, as one of the key threats to the homeostasis of the money, results in its purchasing power loss every year hence the other side of inflation. A mere 2% inflation rate is insidious on savings, the tone of time only adds decay to the savings. Instead, investment makes more for those investments that grow more than inflation, such as stocks and real-estate.

What will be the cost of healthcare in retirement?

In retirement, healthcare is considered to be one of the main and greatest expenses. Medicare, which covers most of the costs, still does not cover everything, like long-term care. Supporting insurance plans, health savings accounts, and long-term care insurance are the ways medical expenses are managed. The financial security of old age will be achieved by planning for potential healthcare costs.

Tax Considerations for Retirement Savings

Retirement savings and withdrawal strategies are influenced by the way taxes affect them. Tax-deferred growth and withdrawal are provided by Traditional 401(k)s and IRAs but require income tax on withdrawals. Through Roth accounts, one gets tax-free withdrawals while after-tax contributions are a must.

How to Avoid Running Out of Money in Retirement

Theanine is a safe and natural option for anxiety and depression sufferers. The 4% rule states that one should take out 4% of their savings each year in order to have a slow but steady income. During the times when the stock market goes down, one should cut the expenses in order to avoid the use of the completions of one’s resources.

Conclusion

The sum that you need to retire is not fixed, it is determined by the income that will substitute, savings objectives and plans in advance. The more prepared the person is the better. A pensioner should be able to cope with the financial insecurity and the lack of the ability to live a decent retirement.

Reference: Learn more from Fidelity’s Retirement Planning Guide.